Keep in mind that some institutions may have lower closing costs than others, or your current bank may extend you a special “existing clients” offer. Be sure to compare APRs, which include many additional costs of the mortgage not shown in the interest rate. When you compare, it’s important to look at not just the interest rate you’re being quoted, but also all the other terms of the loan. Shopping around for quotes from multiple lenders is one of Bankrate’s most crucial pieces of advice for every mortgage applicant.

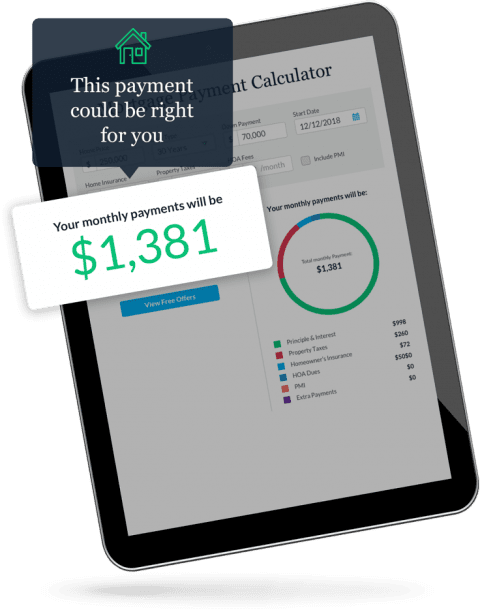

You can use Bankrate’s mortgage refinance calculator to run the numbers. While interest rates no longer are at historic lows, you might be able to do a cash-out refinance to pay for renovations. One silver lining: Rates on jumbo mortgages have been below rates for conforming mortgages, so Californians who need to borrow more than $1 million can do so at favorable rates. Still, the seemingly here-to-stay higher rate environment means housing affordability, already a challenge in California’s high-priced real estate market, presents an even higher hurdle. So far, in 2023, they’ve plateaued somewhat in the 6 percent range.

After hitting record lows in 2021, mortgage rates rose sharply in 2022. Current mortgage interest rates in CaliforniaĪs of Saturday, June 10, 2023, current interest rates in California are 7.11% for a 30-year fixed mortgage and 6.47% for a 15-year fixed mortgage.

0 kommentar(er)

0 kommentar(er)